Why are mobile payments still late in Germany?

High commissions, card and cash habits, distrust and advanced age of consumers and cybersecurity risks discourage Germans

Today there are many mobile payment options.

Especially smartphones, smartwatches or other wearable devices can be used for this purpose.

However, payments by debit or credit card or in cash are even more frequent, even if we live in a world with a high rate of digitalisation.

Why are mobile payments not yet widespread in Germany? What are the advantages and disadvantages?

And why do Germans currently prefer to use card payments or banknotes and coins?

Immediate cryptocurrency payments for Ferrari in the United States, but…

Lugano epicenter of the debates on Bitcoin and individual freedoms

Why German citizens love cash so much

Cash brings with it a certain habit of intimacy.

Many people prefer traditional payment methods, such as banknotes or cards, because they are familiar with them.

Furthermore, in Germany, people often take a purse with cash or a credit or debit card with them simply because they are used to doing so.

In fact, some people already own a wearable device or at least a smartphone, but most of the time they don't think about this possibility when they are at the checkout counter in a commercial establishment.

Out of habit, in these stressful situations we take out our purse.

Furthermore, cash has many advantages.

On the one hand it provides financial privacy and on the other hand it does not have to depend on technology.

This is especially true for older people.

The latter, in fact, are not as technological as young people, because they did not grow up in the time of digital transformation.

Furthermore, a failure of the electricity grid would paralyze the cash systems.

Cash is also used for small sums, such as pocket money and tips.

Small businesses often only allow card or digital payments for large amounts because otherwise they would have higher transaction costs.

In a cashless country, these companies would have liquidity problems.

Finally, cash provides a feeling of security and control.

Expenses are better controlled if you have the budget in your pocket and do not use digital payment methods.

Payments in installments with PayPal up to the limit of 2 thousand euros

The tokenization of real assets? Philosopher's stone of finance

The reason why mobile payments are delayed

As mentioned above, most people are used to cash and card payments and don't immediately think about mobile payment methods.

But “virtual currencies” like the smartwatch or smartphone bring with them real challenges.

First, they require a certain learning process.

You need to learn how they work: they must be activated and the credit card must be previously connected to the device.

Many people don't trust digital payment methods because every online transaction can be tracked.

This is in contrast to financial privacy, as people feel “watched” and this discourages them.

The Swiss Army has digitized payments to troops

The Impact of SEC Actions and Crypto News

A weaker infrastructure than that in China and the USA

But weaker infrastructures also contradict the progress associated with these payment methods.

Compared to countries like China or the United States of America, the infrastructure for mobile payments is not sufficiently developed in Germany.

There are fewer places that accept them and fewer retailers that support these payment methods.

Additionally, many consumers are concerned about potential security risks.

They worry about dangers such as data loss or cyberattacks.

Of course, it must be considered that cash also brings with it some security shortcomings, because it can be easily stolen or lost.

Because digitalization makes door-to-door sales superfluous

Will 6G sanction the swan song of smartphones?

Illustrate the pros and cons, keeping an eye on fragmentation

The advantages of mobile payments are convenience, speed and additional security features such as fingerprint or face recognition.

However, these benefits need to be communicated more effectively and safety concerns eliminated in order to gain consumer trust.

It is necessary to offer adequate learning opportunities, which clarify both the benefits and the risks.

In addition to infrastructure expansion, more support from retailers and banks is needed.

There are many mobile payment providers, for example Apple Pay, Google Pay e Samsung Pay, which leads to a certain fragmentation.

Most banks do not support all of these services, making them problematic to leverage.

Overall, mobile payment offerings should be standardized.

All these measures together can help increase the popularity of paying with smartphones, smartwatches or other wearable devices in Germany.

Innovation Park: a future Blockchain-formatted city in the desert

Nexi-Microsoft: agreement for the European economic digitization

The use of LinkedIn from your smartphone by a user

Here's how Amazon apps work on Android and iOS

From 6G technology to the use of "mixed augmented reality"

You may also be interested in:

In Alto Adige today EDIH NOI is the new point of reference for AI

4,6 million euros from the PNRR fund will be allocated to Bolzano for services to local companies in the digitalisation of intelligence…

by Editorial staff Innovando.NewsEditorial staff of Innovando.News

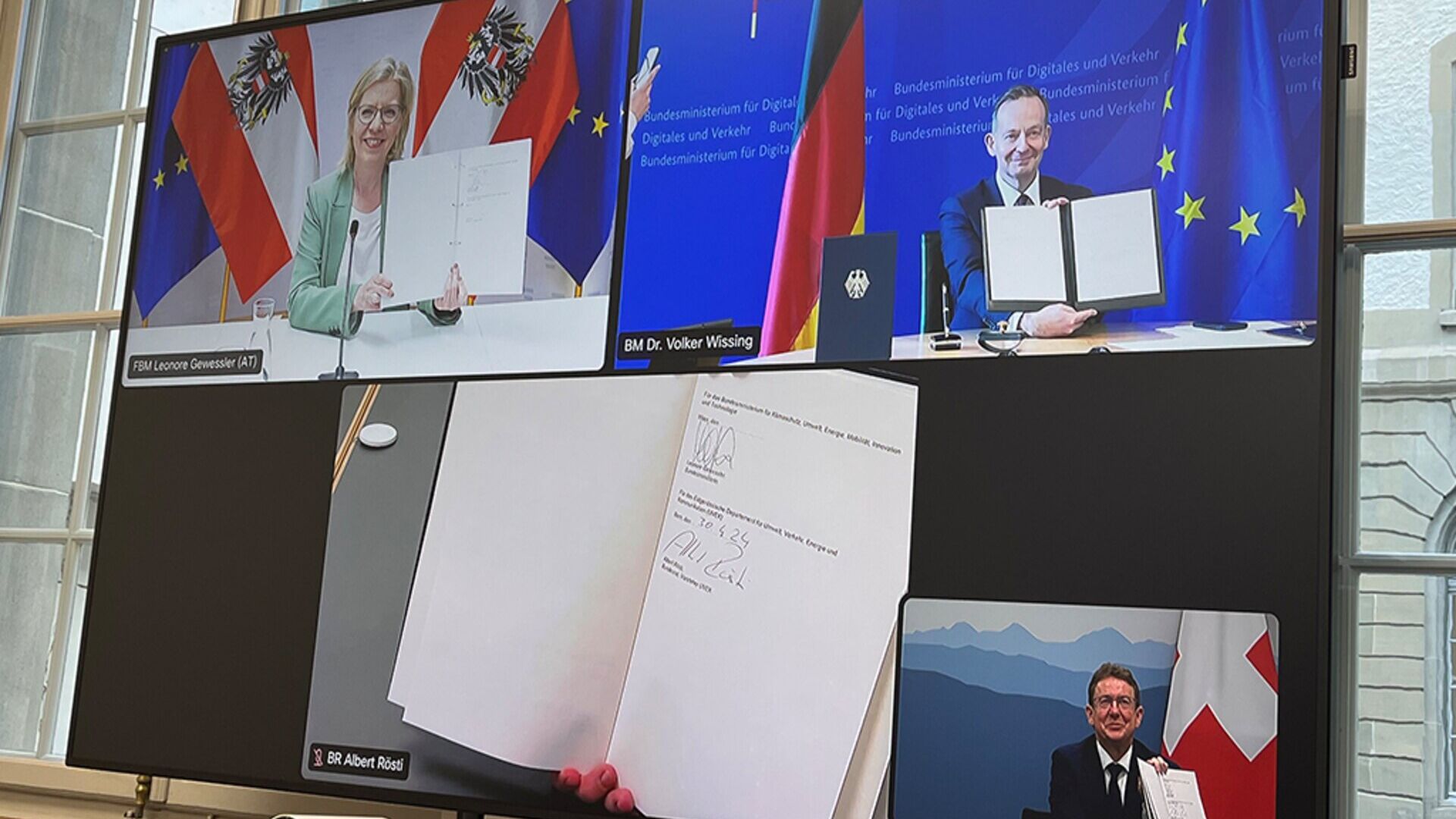

Austria, Germany and Switzerland for "more innovative" cargo railways

DACH Ministers Leonore Gewessler, Volker Wissing and Albert Rösti: the introduction of Digital Automatic Pairing is a key element

by Editorial staff Innovando.NewsEditorial staff of Innovando.News

Persuasion or manipulation? Genesis and historical impact of PR

This is how Public Relations, from the sophistic dialogue of ancient Greece to the current digital era, continues to offer continuous innovation

Young people and cryptocurrencies: how to find out more about Bitcoin…

Introducing kids to digital currencies and Blockchain can be an exciting endeavor, given their affinity for technology and innovation